Financial Savings Plan for Your Life Insurance PRUSaver

All about PRUSaver

Secure your financial needs with the right protection

Savings Made Easy

Building a Fund to Achieve Your Dreams

Money When You Need It Most

Saving Your Money to Secure Your Dreams

-

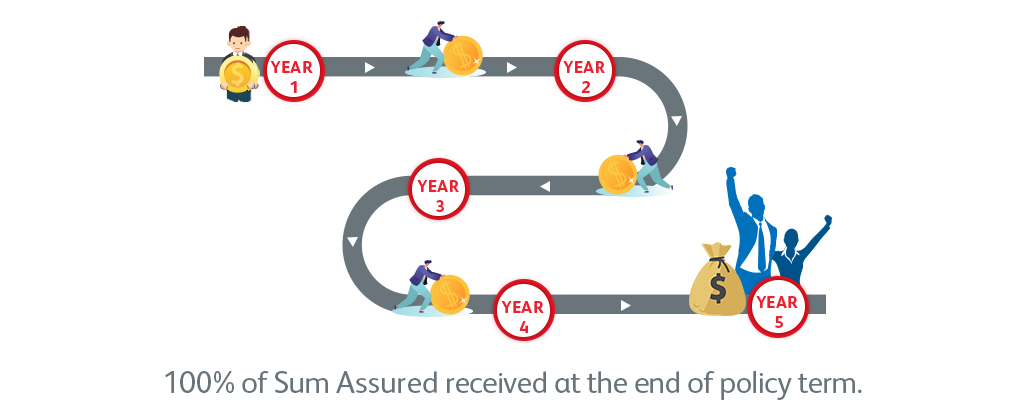

Sum Insured (amount of cash you are saving for) – 5,000,000

-

MMKPolicy Term (amount of time you need to save) – 5 years

-

Annual Premium (amount you need to pay every year) – 954,000 MMK

-

Maturity Benefit (what you’ll get when you’re finished saving) - 100% of Sum Insured received at the end of the policy term.

Financial Protection When the Unexpected Happens

-

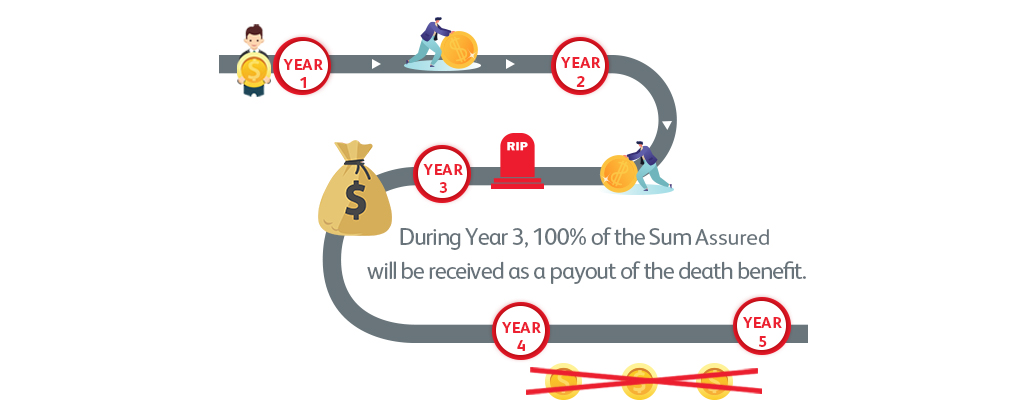

Sum Insured (amount of cash you are saving for) – 5,000,000 MMK

-

Policy Term (amount of time you need to save) – 5 years

-

Annual Premium (amount you need to pay every year) – 954,000 MMK

-

Scenario Example: Should the Insured pass away during Year 3 of the policy, the beneficiary of the Insured will receive a payout of the death benefit which is 100% of the Sum Insured. Following payout of the death benefit, the policy will be terminated.

Enjoy Tax Relief with PRUSaver

PRUSaver savings and insurance plan payments may be tax deductible. This can reduce your annual personal income tax and makes payments to your policy more affordable. Our PRUTax Calculator (link to be added) estimates the tax savings that you could potentially enjoy if your PRUSaver savings and insurance plan payments are tax deductible. You should seek professional tax advice to understand what tax deductions, if any, apply to your individual circumstance.

Reminders Before Signing Up for PRUSaver:

-

Product Exclusions – There are conditions that may affect the full payout of the death benefit or the total and permanent disability benefit. Death claim may not be paid if cause is due to suicide and/or there was material misrepresentation at the time of purchase. Total and permanent disability claim may not be paid if cause is self-inflicted, use of prohibited drugs and more. Please refer to the detailed terms and conditions in the Insurance Policy Contract to get a more comprehensive understanding of the plan.

-

You may be required to undergo a medical examination and to make declarations about your health and physical condition before purchasing this product. This may be due to amount of your sum assured, age and/or occupation.

-

The policy coverage will be terminated if Prudential Myanmar uncovers that incorrect information was shared regarding the medical and/or physical condition of the Insured.

-

Should you purchase this product and decide to discontinue paying it, a surrender value may be available for you. However, this amount is substantially lower than your paid premiums and it may mean some losses for you.

-

To maximize the value of this product, 56 years old and older must file premium payments to this product as tax deductible. Not doing so may result to possibly paying more than maturity value of this product.